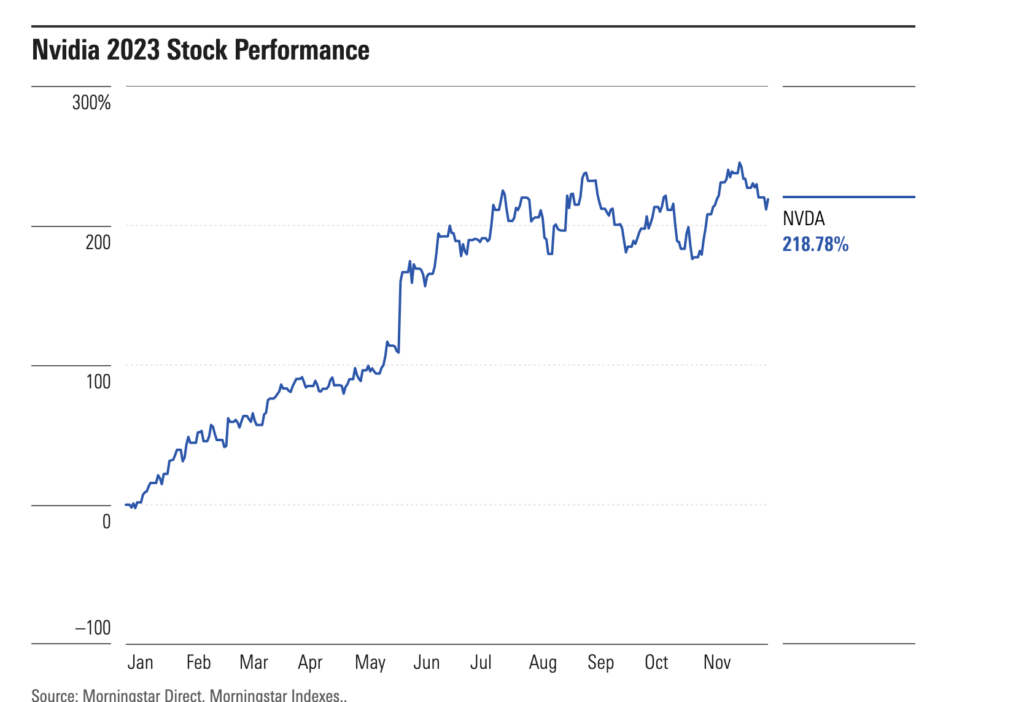

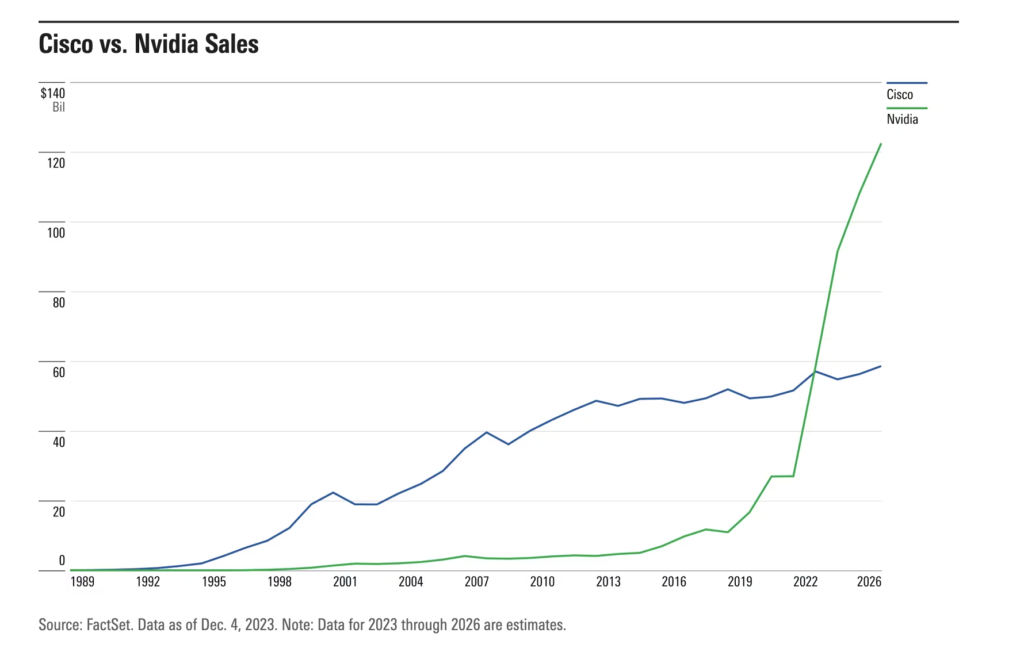

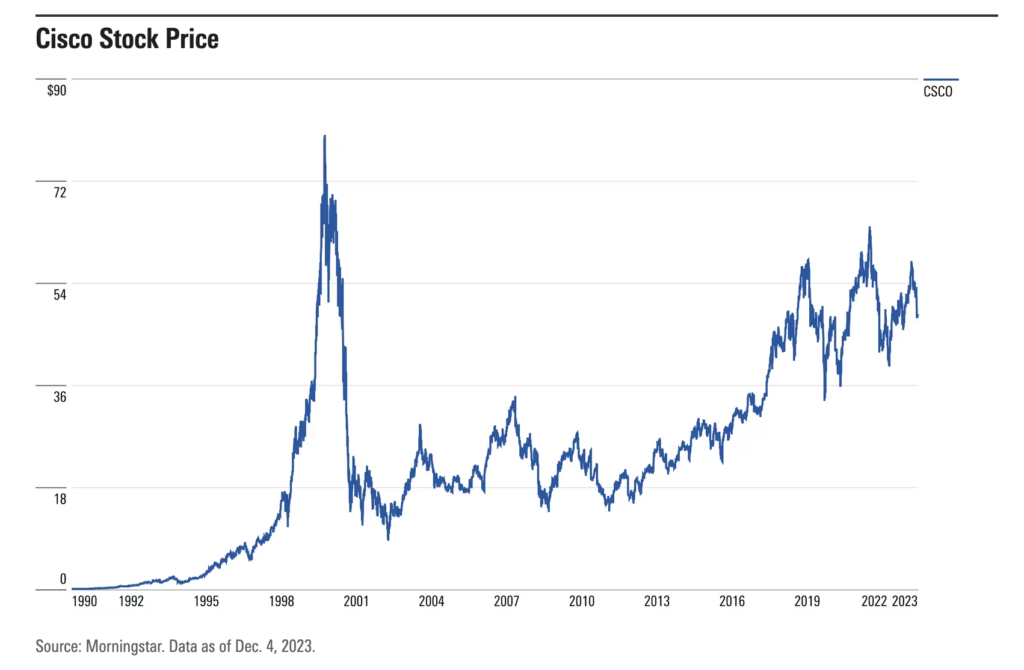

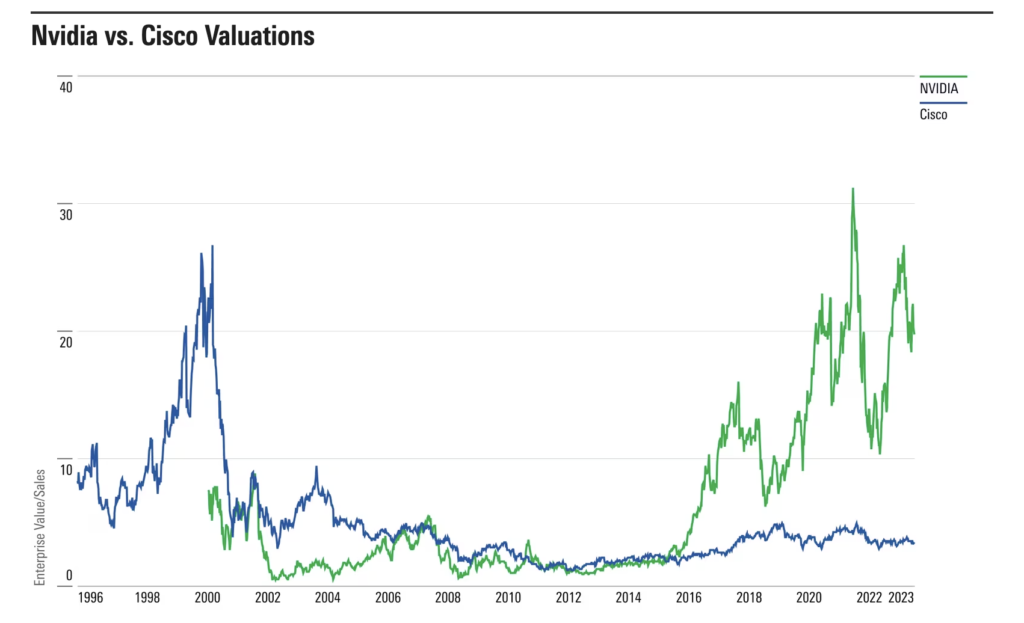

In the dynamic world of technology investments, the meteoric rise of Nvidia in 2023 draws compelling parallels to Cisco’s illustrious ascent in 1999. Both companies, pivotal in their respective eras, rode the waves of transformative technologies, showcasing staggering growth and enviable profit margins. Nvidia, with its cutting-edge products in AI and gaming, mirrors Cisco’s role in the internet boom. However, the looming question remains: Will Nvidia’s story echo Cisco’s post-1999 trajectory, where the latter faced a precipitous decline after the dot-com bubble burst?

I argue for a more cautious, even bearish stance towards Nvidia’s current valuation and future prospects, diverging from the optimistic frenzy that often accompanies such tech darlings. The lessons from Cisco’s history serve as a stark reminder that no company, regardless of its innovation or market dominance, is immune to the laws of market cycles and valuation gravity. Nvidia’s sky-high valuation, fueled by speculative fervor around AI and gaming, seems to overlook the potential risks: regulatory challenges, fierce competition, and the inevitable normalization of growth rates.

Moreover, the broader economic context cannot be ignored. The tech sector’s explosive growth in the 2020s, much like in the late 1990s, has been buoyed by unprecedented monetary policy and investment trends that may not sustain. As Howard Marks aptly noted, “There’s no investment idea that is so good that it can’t be spoiled by too high an entry price】. Nvidia’s current price levels suggest an expectation of perpetual high growth, a premise fraught with risk in a market environment that is increasingly volatile and uncertain.

In conclusion, while Nvidia’s technological contributions and market position are undeniable, the lessons from Cisco’s past and the current market dynamics warrant a more cautious approach. Investors should temper their expectations and be wary of the hype, recognizing that even the brightest stars in the tech universe are not immune to the cycles of boom and bust.

🌐 Sources

- businessinsider.com – Big Pullback Could Hit Nvidia’s Stock After Earnings

- businessinsider.in – An immediate pullback could hit Nvidia’s stock with its…

- buildingbenjamins.com – NVIDIA’s AI Boom is Similar to Cisco’s Internet…

- reddit.com/r/stocks – Could NVDA go the way of Cisco?

- morningstar.co.uk – Nvidia 2023 vs Cisco 1999: Will History Repeat?

- barrons.com – Why Nvidia Stock Doesn’t Risk a Dot-com Style Collapse…