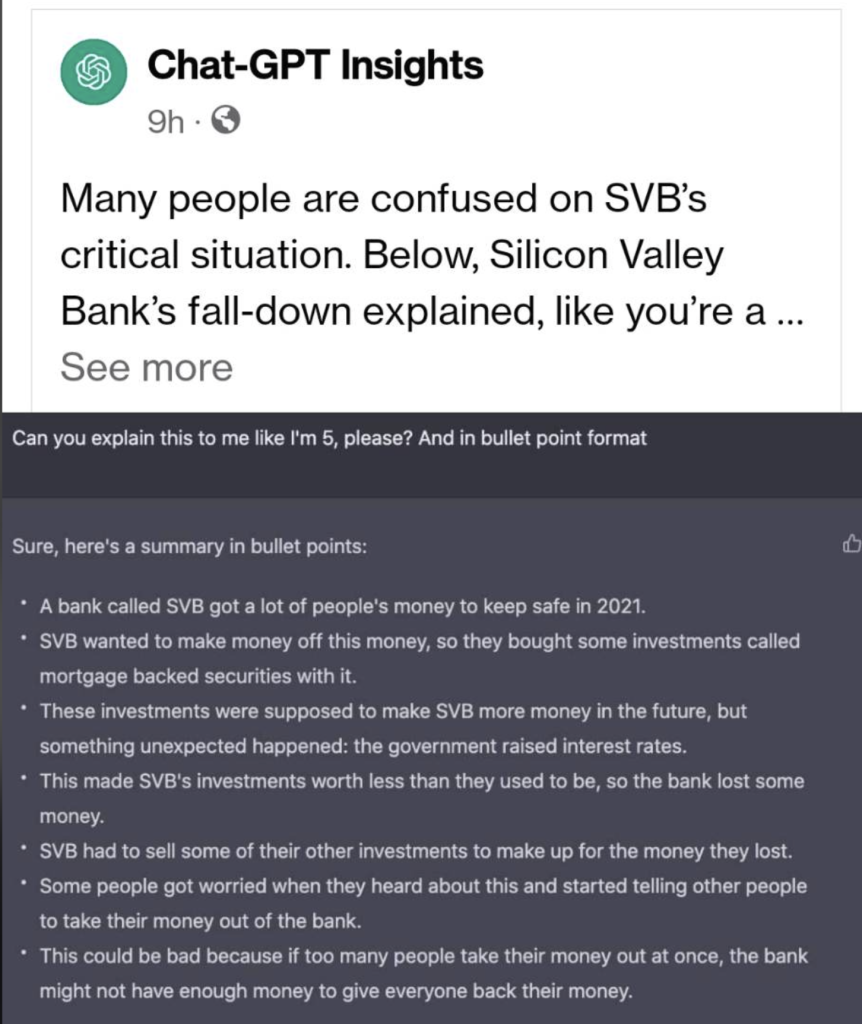

The Fed is currently undergoing the largest interest rate hike in history, causing banks to be affected as the price for bonds decrease. This is causing concerns in the financial sector that are spreading throughout the market, leading to a slump in the bank sector triggered by Silvergate and SVB Financial.

Silicon Valley Bank, a popular financial institution for tech and life sciences startups, experienced a significant drop in its shares, leading to a loss of $9.4 billion in market value. This comes after the bank held around $209 billion in total assets at the end of December, making it the second-largest failure of a federally-insured bank in US history.

Several venture capital firms have advised their portfolio companies to consider withdrawing their money from SVB due to concerns about the bank’s stability. Some venture capitalists and founders have faced difficulties in moving their money, which could impact the ability of startups to pay their staff, affecting the larger startup community.