In the vibrant tapestry of East Asian culture, the arrival of the Year of the Dragon ushers in a time of celebration, prosperity, and cultural significance. As this auspicious period dawns upon us, it intertwines with a fascinating narrative unfolding in the world of cryptocurrency, particularly with Bitcoin, the trailblazer of the digital asset space.

Symbolizing power, strength, and good fortune, the dragon holds a special place in Chinese tradition, making the Year of the Dragon a particularly revered time in the Chinese Zodiac. It’s no surprise then that this symbolism resonates deeply with cryptocurrency enthusiasts, as Bitcoin, often likened to digital gold, experiences a surge in value, mirroring the fervor surrounding the festivities.

𝐂𝐡𝐢𝐧𝐞𝐬𝐞 𝐍𝐞𝐰 𝐘𝐞𝐚𝐫 𝐏𝐮𝐦𝐩 𝐇𝐚𝐬 𝐒𝐭𝐚𝐫𝐭𝐞𝐝 🐉

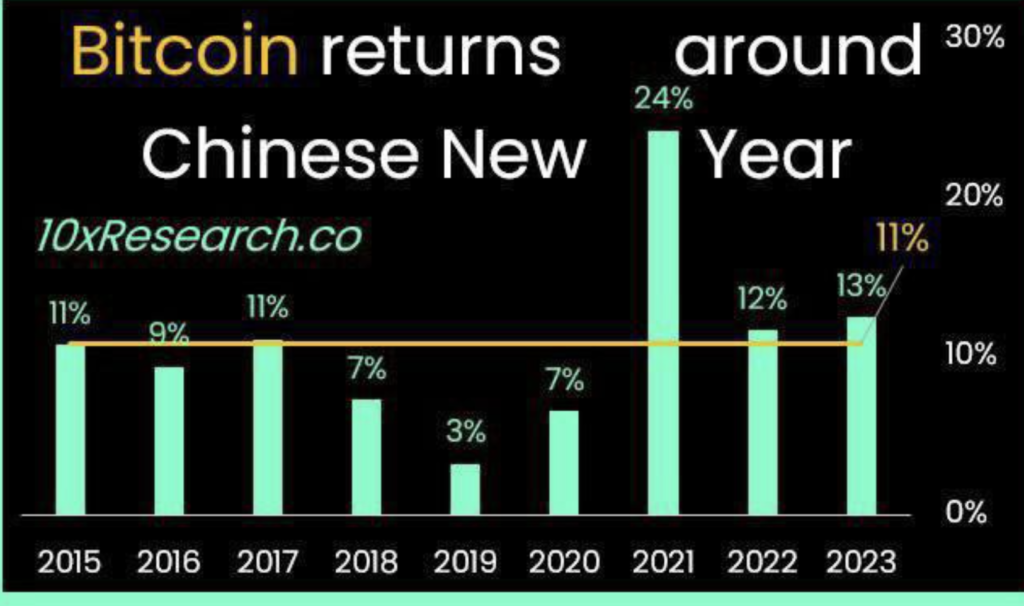

Historically, #Bitcoin pumps an average of 11% during the Chinese New Year.

But there is one more thing most people are not talking about.

Chinese New Year will also be hugely beneficial for tokens that have a… pic.twitter.com/5HQ9Yx6enM

— Elja (@Eljaboom) February 9, 2024

A confluence of factors contributes to Bitcoin’s recent ascent, with the Mandarin term for dragon, pronounced “long” in English, sparking interest and excitement among traders. This linguistic connection adds a layer of intrigue, propelling Bitcoin’s momentum as it charts a course towards a one-month high.

Analysts, drawing from historical patterns, anticipate Bitcoin’s price to soar, potentially reaching dizzying heights of $48,000 in the days ahead. This projection is rooted in the observed correlation between Bitcoin’s performance and the onset of the Chinese New Year, a time marked by heightened trading activity and renewed enthusiasm in the cryptocurrency market.

The excitement surrounding Bitcoin’s surge is further fueled by insights from experts like Thielen, who employ technical analysis methodologies such as the Elliott Wave theory to forecast the digital currency’s trajectory. According to Thielen’s projections, Bitcoin is poised for a bullish run, with the potential to surpass the $52,000 mark by mid-March, signaling a period of sustained upward momentum.

Beyond the realm of speculation, recent weeks have seen a tangible influx of institutional investment in Bitcoin, with various exchange-traded funds (ETFs) absorbing over a billion dollars in selling pressure. This influx of institutional capital underscores the growing mainstream acceptance and adoption of Bitcoin as a legitimate asset class, bolstering its long-term prospects.

As we delve deeper into the historical context of Bitcoin’s performance during the Chinese New Year, a nuanced picture emerges. While the cryptocurrency has exhibited both peaks and valleys during previous iterations of the festival, the overarching trend points towards resilience and potential for growth.

However, amidst the optimism, it’s crucial to acknowledge the lingering skepticism that persists within certain segments of the trading community. On-chain data reveals a cautious sentiment among traders, with concerns regarding market volatility and regulatory uncertainty tempering enthusiasm.

Nevertheless, the overarching narrative remains one of optimism and anticipation, as Bitcoin continues to capture the imagination of investors worldwide. As we navigate the festivities of the Year of the Dragon and beyond, the ascent of Bitcoin serves as a testament to the enduring allure of digital assets and the transformative potential they hold in reshaping our financial landscape.