In the burgeoning AI market, Nvidia and Super Micro Computer have both emerged as critical players, delivering astonishing returns to their investors. Nvidia, known for its cutting-edge GPUs, is essential for training AI models, while Super Micro Computer specializes in building specialized servers that network these GPUs for optimal performance. Despite their symbiotic roles in AI development, Nvidia and Super Micro are not direct competitors, but rather, they cater to different segments of the technology stack.

Over the past year, Nvidia’s stock soared by 530%, and Super Micro’s astonishing 1,300% increase underscores the booming demand for AI capabilities. However, the looming question for investors is whether these stocks still present a worthwhile investment opportunity given their recent explosive growth.

A closer examination reveals that Nvidia, with its unparalleled GPU technology, is nearly indispensable in the AI landscape. This gives it a considerable edge over Super Micro, which, despite its expertise in server technology, faces potential competition in pricing and innovation. Financially, Nvidia also seems to outshine Super Micro, boasting a staggering 265% year-over-year revenue increase in the latest quarter and projecting continued robust growth.

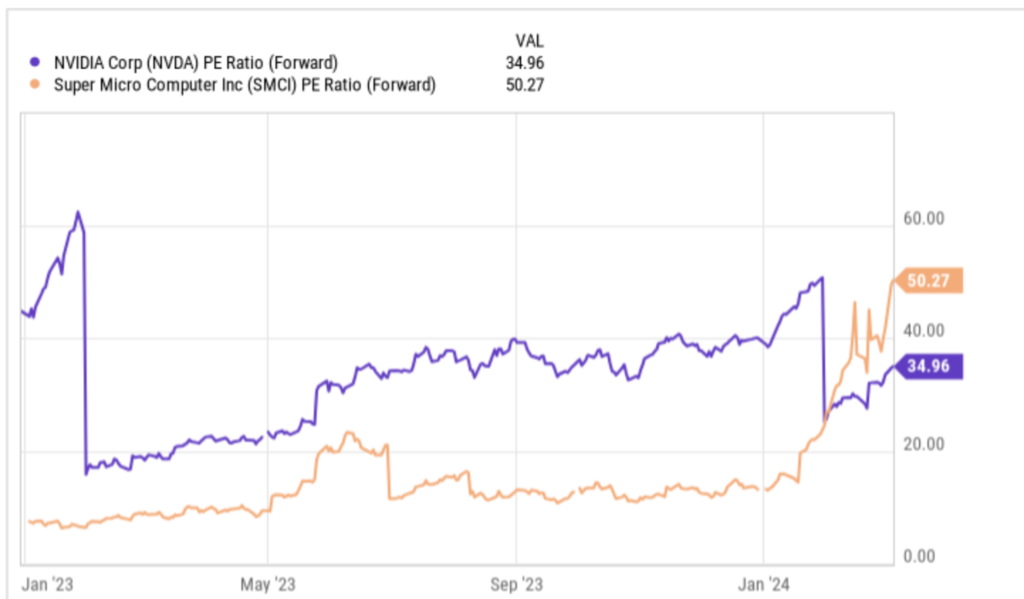

When comparing the two from an investment standpoint, Nvidia’s stock appears more attractively priced on a forward price-to-earnings basis, suggesting it offers a better value for investors. Given its pivotal role in AI development and more compelling financial performance, Nvidia stands out as the premier investment choice in the AI sector.

As AI demand continues to surge, both companies could yield substantial returns, but Nvidia’s unparalleled market position and growth prospects make it the top pick for those looking to invest in the future of AI technology.