Today was one for the books — the markets ripped higher with the largest single-day point gain ever in the Dow, S&P 500, and Nasdaq. On the surface, it looked like pure euphoria… but if you dig a little deeper, it’s clear this was less about confidence and more about crisis control.

The big move came after Trump abruptly announced a 90-day freeze on most tariffs, excluding China. Let’s be honest — this wasn’t some Art of the Deal genius move. It was a reaction to a full-blown meltdown in the bond market. Yields were exploding, hedge funds were forced to unwind massive leveraged trades, and panic was starting to ripple across markets.

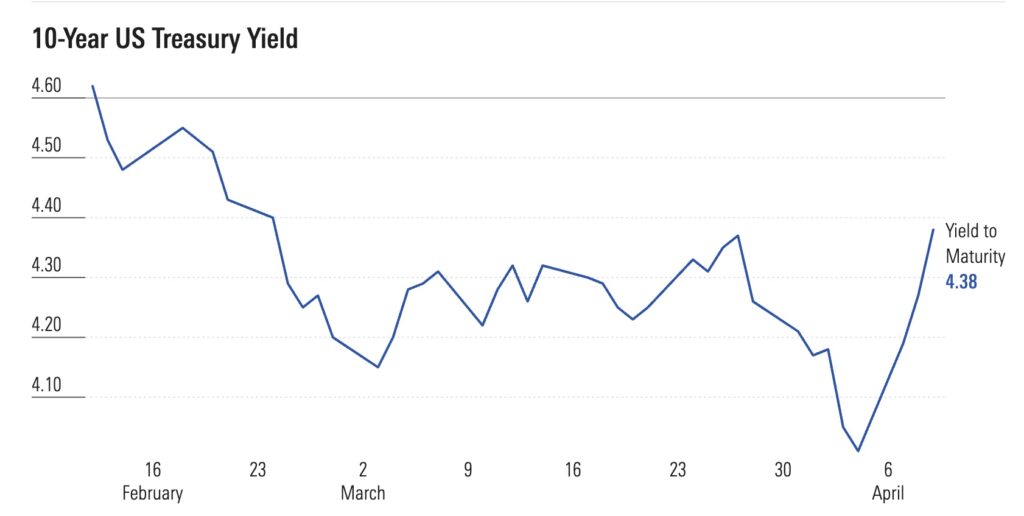

The 10-year Treasury yield spiked past 4.5%, and the 30-year touched 5%. If nothing had been done, we could’ve seen mortgage rates, car loans, and corporate borrowing costs go parabolic. Liquidity was drying up fast — we were staring straight at another 2008-style freeze-up.

So yeah, the market bounced. Hard. But the underlying problems haven’t been solved — they’ve just been temporarily masked.

🔄 My Plan

Right now, I’m riding the wave. I’ll be holding my positions — mostly leveraged ETFs like TQQQ and SPXL — into tomorrow and maybe through the rest of the week if momentum continues.

But I’m not getting greedy.

Once we start hitting key resistance levels, I’m planning to offload positions and look for short setups. The fundamentals still point to a deeper correction ahead, and we’re clearly not out of the woods.

Also — let’s not forget the emotional whiplash investors have been through. This kind of volatility isn’t healthy. The bond market is still fragile, and if China retaliates further or starts dumping U.S. debt, we’re right back in trouble.

📌 Final Thoughts

If this was some planned maneuver? That’s messed up. Playing games with people’s portfolios and livelihoods for a political image — that’s not leadership, that’s reckless.

This rally might’ve bought some breathing room, but I’m staying alert. Being a trader, not a bag holder, is the move right now.

Let’s see what tomorrow brings.

We actually bounced today at the 50% fib retrace. We’re down the next day. On that next leg down, the 618 meets with upsloping parallel which would be a big bounce.